Opt‑Out or Locked Out?

The Two Faces of Debanking

Uncover the Plan B Alternative Banking Solutions Discussed at Mavericks’ 5th Global Mastermind

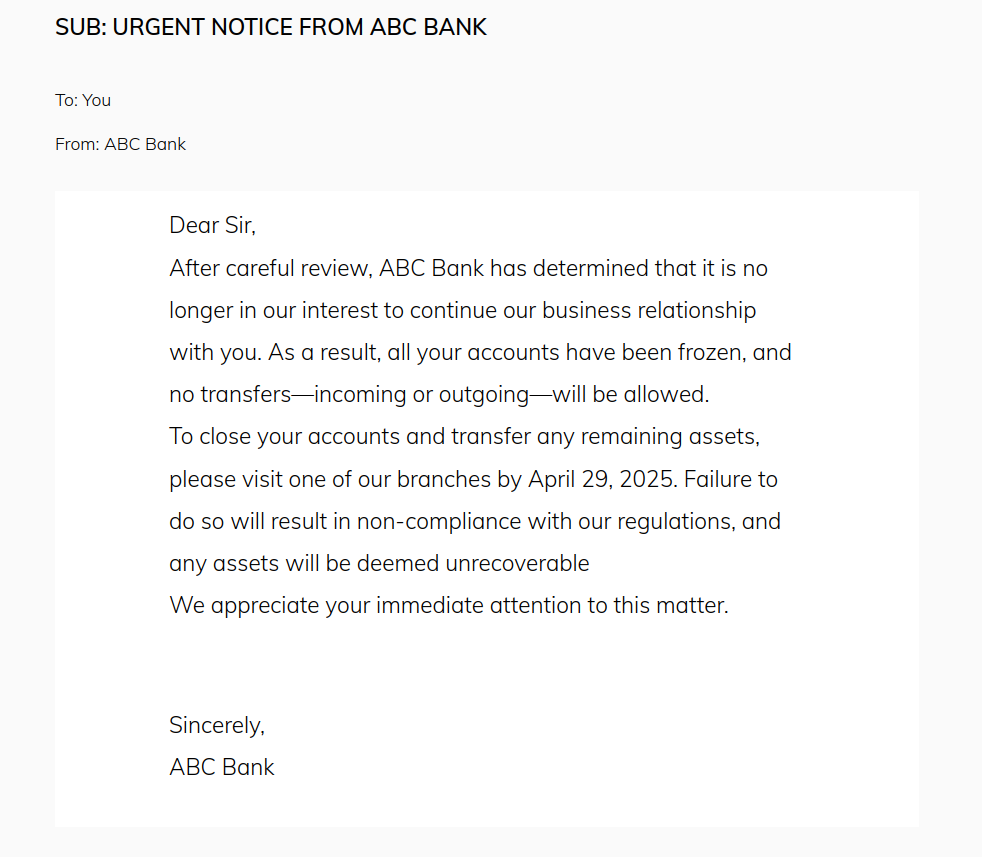

The nightmare of receiving this letter from your bank is increasingly common.

To some of you, it has already happened.

Recent regulatory shifts and rising cases of debanking compelled Andrew and Chris to establish not just a fallback parallel banking alternative, but a capital-first strategy—now serving as Plan A for their fund, Subvertere Capital.

They didn’t just theorize—they built it – at the 5th Mavericks Mastermind in the Cayman Islands.

The recent Mavericks Mastermind had a single objective: Identify and build the rails for a Parallel Banking alternative.

At this Mastermind, we examined everything from services and technologies available, to compliance, jurisdictions and possibilities to building a parallel banking solution for anyone serious about safeguarding their capital—whether as an individual or a fund.

For the first time, Mavericks is releasing the full synthesis—including discussions, solutions, presentation slides, and audio replays—from the Mavericks Parallel Banking Mastermind to all interested parties.

We stand at the precipice of the culmination of a mega-century cycle, an 18-year cycle, and a 7-year monetary cycle.

For those acquainted with history and the inherent cycles of economic systems, this should not be surprising.

The much-anticipated “reset” is imminent.

The pertinent question is: “Reset into what?”

The Old System is Dead.

And what do you do when the old system is broken and no longer works?

You build a new one.

Chris MacIntosh, Andrew Ford and a bunch of mavericks decided to go ahead and do it.

They gathered a small group of bright minds and builders in the Cayman Islands to mastermind solutions to identify and build the parallel banking rails that anyone – including a regulated entity such as an investment fund – can use for unlocking trapped capital.

And so we did.

In fact, we are confident that the totality of the ideas, solutions and banking rails possibilities that were discussed during this Mastermind cannot be found anywhere else.

Now, for the first time since Mavericks Project was launched, you can access the entire Mastermind synthesis including all discussions, solutions and presentations, by purchasing the booklet below.

Key Takeaways

Parallel Banking Infrastructure is Here.

Traditional banking is broken but for the first time in hundreds of years, there’s a way to replace it.

A comprehensive analysis reveals that the components for a decentralized banking system are already in place.

While each option has its advantages and challenges, the first step is awareness of what’s possible and which are the decentralized options.

The Great Alignment Brings the Dawn of Banking.

The Alignment of regulation, technology , politics and market conditions have aligned for innovators to push “banking” into a new direction.

We looked at solutions from both a practical and highly unconventional angle and the result is A Parallel Bank.

Building a Parallel Bank alternative is not only possible, but enough pioneering businesses are using it already.

The Rails Are There. You Just Need to Find the One That Fits You.

Thanks to to a small group of mavericks, a detailed research and solutions mapping has been compiled, identifying a plethora of pieces of infrastructure that enable multiple parallel banking alternatives – depending on each circumstance.

Chris and Andrew choose one such alternative for their new fund –Subvertere Capital.

What’s Inside the Booklet

- Macro overview & failures of monetary-systems.

- Finding compliance that works for YOU, not for the regulator, and where you can find it.

- Review of absurd capital controls and totalitarian nonsense based on recent member stories.

- Use cases of possible Parallel Banking rails, including how to on/ and off-ramp from fiat to crypto and vice-versa.

- The Parallel Banking Blueprint used by the newly investment fund co-founded by Chris and Andrew – Subvertere Capital.

- Principles of the new and emerging Parallel Banking alternatives.

- Cayman Islands hub for innovation, ideology-free compliance & Plan B, and why they are leading in parallel-banking innovation.

- Some less-than-orthodox ideas and presentations.

- Wealth diversification strategies in a highly uncertain decade.

- Subvertere Capital pipeline of deals & other member projects.

A New Era of Forced Debanking & Voluntary Unbaking is Barely Starting…

Chris and Andrew – the cofounders of Mavericks Project – have understood that in order to build and store wealth, we need efficient means to move and allocate capital.

In fact, they experienced the stark reality of the broken banking system when they tried raising capital for one of their deals as part of Subvertere Capital.

Everything was ready, the deal fully funded, but they couldn’t get the investors’ capital to deploy. Guess why? The nightmare of opening a bank account to accept investor’s money from around the world.

For anyone who recently tried to set up a new investment fund and open a bank account to raise capital, you already know what a regulatory nightmare this is.

But the problem isn’t unique to the fund managers.

Anyone who recently tried to move a substantial amount of money from Bank A to Bank B, will know how impossibly difficult today’s banking regulations have done this.

And it is only getting worse.

In less than half a century, banking moved from opening a bank account instantly with little to no question asked, to today’s times, where the bank demands an arm, a leg and your first newborn to open up a bank account.

All of this just to give them money. Can anyone see anything rotten here?

Well Mavericks did.

And in true maverick spirit they pooled their resources and built solutions, which you can access at the link below.

Alternatively, if you wish to join the Mavericks group, and masterminding with them solutions like these, join us.

Note that joining requires a thorough vetting process and approval isn’t guaranteed. There is also a joining fee.

About Mavericks Project

Mavericks Project is a private network of affluent individuals with an active interest to build and preserve wealth in times of change. This isn’t a fancy elite club of people gathering for a nice rum to discuss politics. Most love a good rum and a nice cigar but the key reason why we meet is to connect, build, create and to drive solutions to those problems.

Here’s what you will get

- A +40 page report with a full synthesis of everything discussed at the Mavericks Parallel Banking Mastermind

- A list of 20+ presenters audio replays and the solutions discussed

- Access to the insider pipeline of deals that Subvertere Capital is working on

- A curated list of projects and deals that some of the members are working on

- BONUS – A thick research document with a comprehensive review of existing parallel banking solutions – courtesy of a closed group of mavericks who scanned every piece of solution and infrastructure available to serve our purpose

All of this for just $295 – a bargain.

Freedom is possible for those who seek it and the time to act is now.

We are at cross-roads. We’re either heading towards an Orwellian banking alternative or towards a freedom-oriented alternative.

To shape a future of banking that includes the latter, the first step is to understand what is possible and prepare accordingly.

As Chris likes to say: become like water.